Wednesday, 22 February 2023

5 Tips for Budgeting Success

Setting and sticking to a budget is the best way to stay on top of your finances. Making and sticking to a budget means you’re paying all of your bills on time and not acquiring unnecessary debt, which keeps your credit history and credit report positive. This is essential when it comes time for big life goals such as buying a home or applying for a new job when credit checks will be run on you.

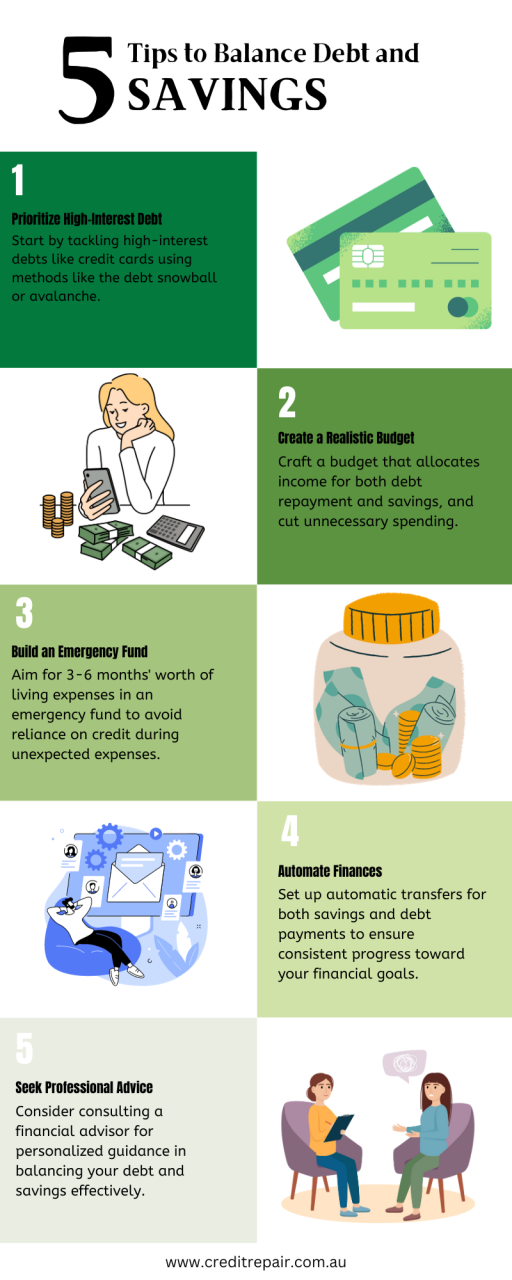

To stay on top of your budget, and your credit score, simply follow our five-step guide to budgeting success!

1. Set some goals

The key to improving your financial future is creating a cash surplus that you can save and invest — be it in managed funds, paying off your mortgage faster, make additional super contributions or saving for your children’s higher education. Creating a budget, and sticking to it, is the way to achieve this. To get and stay motivated, figure out what your primary goals are, the timeframe in which you hope to achieve them, and how much money you need to save to make those dreams a reality.

Read next: Top habits of people with excellent credit reports.

2. Create a budget

The best budgets are simple and easy to stick to so aim to ‘set and forget’ yours. In a perfect world, this might look something like: One-third of your (after-tax) income for expenses, one third for savings and one-third for personal spending money. But even regularly putting aside five to ten per cent of your income is a terrific place to start. Have a play with ASIC’s Budget Planner to work out where your money is going, where you could save, to create a realistic budget that works for you and your life circumstances.

3. Track your spending

In order to stick to your budget, you’ll need to record your spending and do weekly or monthly check-ins. Take advantage of the many financial software packages and apps available. Some great free personal finance apps available on iOS and Android that have budget tracking capabilities include Pocketbook (getpocketbook.com), Wally (wally.me), MoneyBrilliant (moneybrilliant.com.au) and ASIC’s TrackMySpend (from moneysmart.gov.au).

4. Identify budget busters

Make a list of major expenses you could live without. These may include cable television, gym memberships, new car payments or the weekly cleaner. Commit to sacrificing one big expense this year and save that money instead.

According to Hannah McQueen, author of Kill Your Mortgage and Sort Your Retirement, most of us fritter away 10 to 20 per cent of our income on unnecessary items. Identifying small but regular expenses, which aren’t really adding that much value to your life, can really add up. Perhaps it’s that second latte of the day, buying instead of bringing lunch to work, or purchasing books new when you could use the local library.

5. Reward yourself

Use small treats as incentives to keep going. Nothing so expensive that it’s going to undo all your hard work but something that will give you a tangible positive reward for sticking to your budget. Maybe it’s, “When we stick to our weekly grocery budget we can get takeaway on Friday nightâ€.

When it comes to keeping your finances in good shape, it’s important to be aware of your credit history and how it may affect you. Credit Repair Australia can help you get a free copy of your credit report.

since version 3.0.0 with no alternative available. Please include a comments.php template in your theme. in

You're an Australian resident

You're an Australian resident You're between 18-65 years old

You're between 18-65 years old You or your partner have a regular income

You or your partner have a regular income You may need to borrow money or take control of your debt

You may need to borrow money or take control of your debt You may have been declined for a loan or have trouble paying your debt

You may have been declined for a loan or have trouble paying your debt We'll work with you fully understand your financial situation

We'll work with you fully understand your financial situation We will help you understand your credit report and the areas for improvement

We will help you understand your credit report and the areas for improvement You may yourself without charge obtain a copy of your credit record and challenge any entry on your credit report

You may yourself without charge obtain a copy of your credit record and challenge any entry on your credit report If you're applying for credit restoration improvement, we cannot guarantee that all adverse credit notations are removed from your credit report

If you're applying for credit restoration improvement, we cannot guarantee that all adverse credit notations are removed from your credit report We can only use our best endeavours to ensure that your credit record is true and correct

We can only use our best endeavours to ensure that your credit record is true and correct We will not provide you with any Insolvency services unless and until we've advised you that you may obtain help, free of charge, with credit and debt related problems from community based financial counsellors.

We will not provide you with any Insolvency services unless and until we've advised you that you may obtain help, free of charge, with credit and debt related problems from community based financial counsellors.

Leave a Reply