Law changes in March 2014 altered what information is collected on your credit file. We will examine how ‘positive’ reporting can help you.

Your credit score is not fixed and will change over time. Here are 10 tips to improve it.

1. Check out your credit file to see where you stand

Get a copy of your credit file and see if there’s an area you need to address. The 3 main credit reporting in Australia are:

- Illion (formerly trading as Dun & Bradstreet Australia)

- Equifax (previously known as Veda)

- Experian Australia

You’re entitled by law to get one free credit report every 12 months, or within 90 days of receiving a credit rejection. For a small fee you can request a report at any time.

2. Ensure your credit file is fair and accurate

Many Australians have errors on their file. It might be identity theft, or just a simple mistake by the lender.

If there’s a mistake on your report, you’ll need to contact:

- Your credit provider

- The credit reporting agency

- The office of the Privacy Commissioner – if need be.

3. Create a relationship with your bank

If you’ve got money regularly coming in, and a bit of a savings record building up, it’s proof you’re a sensible soul (and a good risk).

4. Have a credit card

Oddly, having no debt at all doesn’t make you more creditworthy. In fact, measured credit card use (and prompt on-time payments) is evidence of an ability to manage debt.

If you’re not good at managing a credit card, cut your credit card limit back. It’s also wise to only use it for purchases you know you can afford to repay.

5. Don’t apply for too many credit cards

Each credit application you make is added to your file and lowers your score. Why? Because too-frequent applications can be a sign of financial desperation.

Unfortunately, the ease of online applications – and the fact some customers enter ‘trial’ submissions (to work out what the best deal is) – means many have a lot on their file.

So do your research online, but talk to lenders rather than formally applying (until you’re sure what you want).

6. Pay your credit card and loans on time

Have a reminder system so you’re never late with your credit card bill. Even better, set up a direct debit to cover your minimum payment.

Your credit card and loan info is recorded on your report for two years.

7. Demonstrate general bill-paying reliability

Although your credit report does not include information about your payment of utility bills (electricity, water or gas) or phone bills (home, mobile and internet), it’s important to pay these bills when they’re due.

If you don’t make payment on these services, your credit provider may refer your debt to a debt collector and/or report your debt to a credit reporting agency – asking them to record the default on your credit report.

8. Use a variety of credit types

If you’re able to successfully manage several debts – say a car loan, a credit card, a mortgage – your credit score will rise.

9. Don’t throw away a rarely used card

Even if you’ve finished paying your credit card debts, don’t close the account. Keeping it open, with no negative reports, will impact favourably on your overall score.

10. Don’t change houses and jobs frequently

Lenders want evidence that you’re a stable character. They want to see you have staying power – that you’re not here one day, gone the next. Put simply, they want evidence of stability so try not to change jobs and addresses too frequently.

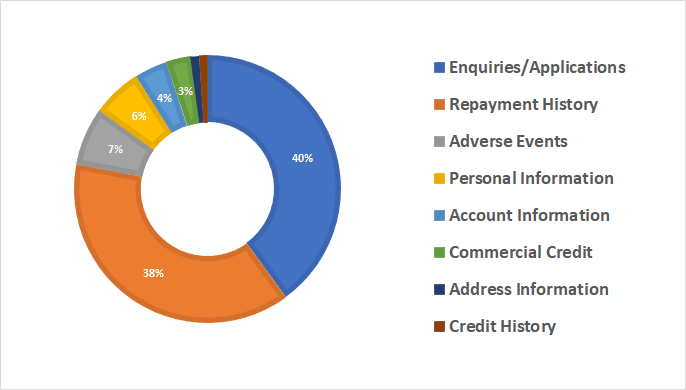

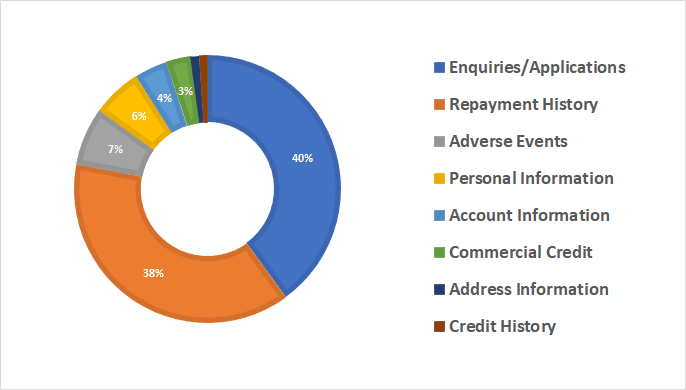

11. Know what makes up your credit score

It’s easier to protect your score if you know what the important factors are. The chart below shows how one of the agencies determines your score.

Disclaimer: This article is for general knowledge and may not reflect your individual situation or requirements. You should seek your own advice. Finance approval will be subject to individual lenders credit criteria.

You're an Australian resident

You're an Australian resident You're between 18-65 years old

You're between 18-65 years old You or your partner have a regular income

You or your partner have a regular income You may need to borrow money or take control of your debt

You may need to borrow money or take control of your debt You may have been declined for a loan or have trouble paying your debt

You may have been declined for a loan or have trouble paying your debt We'll work with you fully understand your financial situation

We'll work with you fully understand your financial situation We will help you understand your credit report and the areas for improvement

We will help you understand your credit report and the areas for improvement You may yourself without charge obtain a copy of your credit record and challenge any entry on your credit report

You may yourself without charge obtain a copy of your credit record and challenge any entry on your credit report If you're applying for credit restoration improvement, we cannot guarantee that all adverse credit notations are removed from your credit report

If you're applying for credit restoration improvement, we cannot guarantee that all adverse credit notations are removed from your credit report We can only use our best endeavours to ensure that your credit record is true and correct

We can only use our best endeavours to ensure that your credit record is true and correct We will not provide you with any Insolvency services unless and until we've advised you that you may obtain help, free of charge, with credit and debt related problems from community based financial counsellors.

We will not provide you with any Insolvency services unless and until we've advised you that you may obtain help, free of charge, with credit and debt related problems from community based financial counsellors.